- Wondering if USA Rare Earth stock is trading at a bargain or overpriced? You are not alone, especially as investors look for opportunities beyond the usual headlines.

- The shares have delivered an impressive 82.9% return over the last year, even after a recent pullback of 18.2% in the past week. This hints at both growth potential and shifting sentiment.

- Recent news coverage has highlighted ramped-up interest in U.S. domestic rare earth supply chains and government policy shifts. Both factors have contributed to stronger investor optimism. Headlines around securing critical minerals and expanding production have put USA Rare Earth in the spotlight and helped fuel some of these rapid price movements.

- At first glance, the company’s valuation score stands at 2 out of 6, suggesting plenty of room for debate. Up next, we will break down how valuation is measured, and at the end introduce an approach that could provide even deeper insights.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them to reflect their value today. This method gives investors a forward-looking view based on both current performance and expectations for growth or contraction.

For USA Rare Earth, analysts estimate the company’s recent Free Cash Flow (FCF) at negative $31.48 million. Analyst forecasts suggest cash flows will remain volatile over the coming years, with negative FCF through 2027 before turning positive. By 2029, the company’s FCF is expected to reach $122.58 million. Beyond analyst forecasts, projections up to 2035 (using Simply Wall St’s methodology) indicate ongoing growth in FCF, potentially rising further as the company scales operations.

With these cash flow projections, the DCF valuation assigns an estimated intrinsic value of $79.06 per share. Compared to the current share price, this implies that USA Rare Earth stock is trading at a 75.1% discount. This substantial undervaluation suggests there may be significant upside for investors if management can deliver on the anticipated growth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 75.1%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for USA Rare Earth.

Approach 2: USA Rare Earth Price vs Book

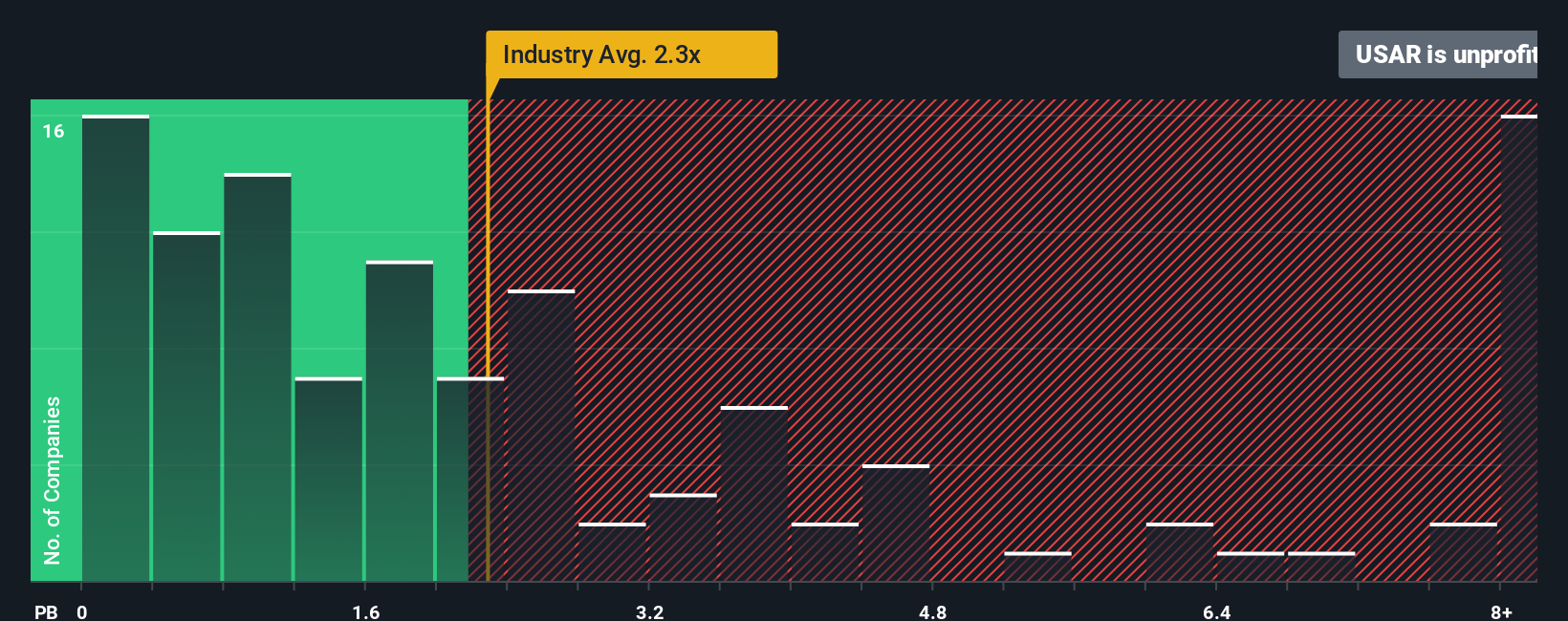

The Price-to-Book (P/B) multiple is a popular valuation tool for companies in asset-heavy sectors like metals and mining. It helps compare a company’s market value to the value of its net assets, making it especially useful for businesses without steady profits or when earnings are less meaningful due to negative results or volatility.

Growth prospects and risk profiles play key roles in shaping what investors view as a reasonable or “fair” P/B multiple. Companies with faster asset growth or lower risk often trade at a premium to book value, while higher risk or slower-growing firms typically command lower multiples.

Currently, USA Rare Earth’s P/B ratio stands at -14.29x. For context, the industry average is 2.28x, and the average among its closest peers is 14.90x. The negative ratio is unusual and generally reflects negative book value, which signals significant accumulated losses or writedowns. This is a factor that should put investors on alert when making direct comparisons.

Simply Wall St’s “Fair Ratio” refines the analysis by considering the company’s growth outlook, risk, profit margins, industry dynamics and market capitalization. This proprietary metric moves beyond raw peer or industry averages to produce a more tailored benchmark for what the multiple “should” be for USA Rare Earth, given all of its unique characteristics.

Because the current P/B ratio of -14.29x is considerably different from a fair value based on normalized business conditions, and given the negative multiple indicates fundamental concerns, investors should tread carefully. Based on all factors, the valuation appears OVERVALUED using this approach.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1393 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

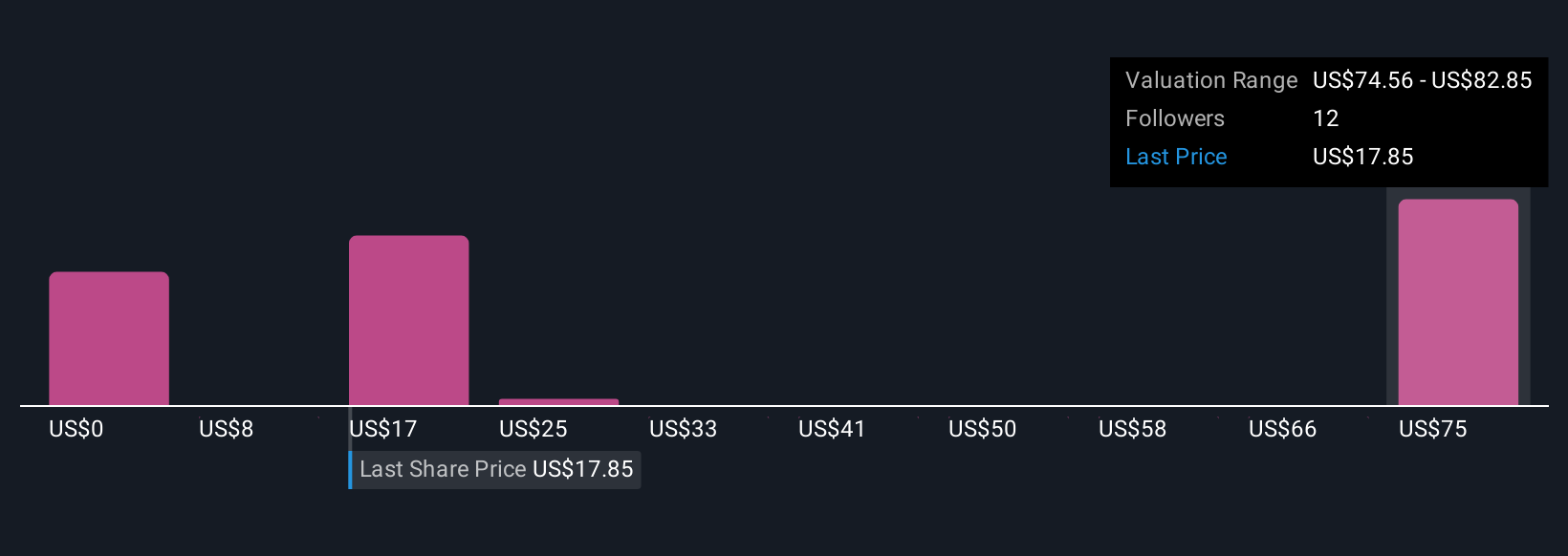

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple tool that lets you create and share your perspective on a company by connecting its story to your own financial forecast and fair value estimate. Rather than just looking at numbers, you can outline what you believe about USA Rare Earth’s future revenue, earnings and profit margins, and see how that plays into its potential fair value, all in one place.

Narratives make it easy to link what is happening at the company to real financials, updating automatically when news, financials or analyst outlooks change. On Simply Wall St’s platform, millions of investors use Narratives within the Community page to compare their views and see where they agree or differ. This helps you decide when a company looks attractively priced (if Fair Value is above the current Price) or may be too expensive to buy.

For example, one Narrative might see USA Rare Earth worth $70 per share if strong government support continues, while another user could value it at just $18 per share if cash flow issues persist. Narratives empower you to make more informed and dynamic decisions.

Do you think there’s more to the story for USA Rare Earth? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com